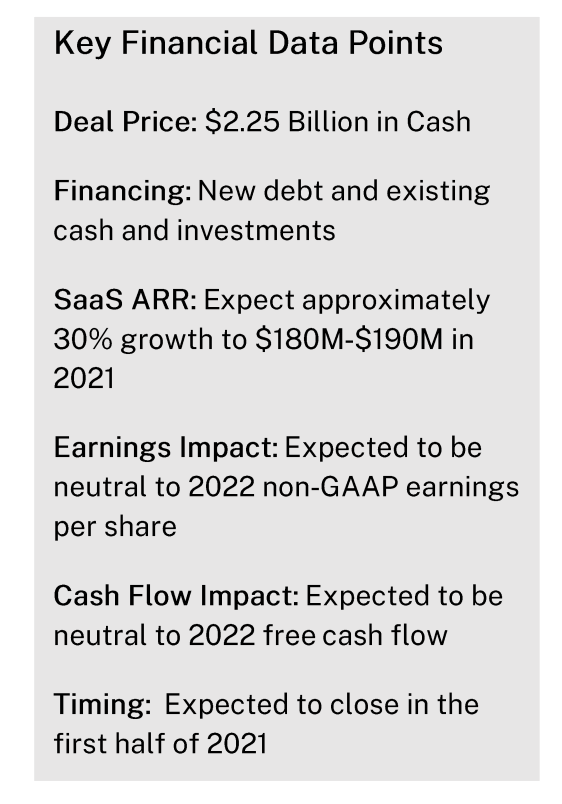

Wrike never went public, but instead was acquired by Citrix for $2.2B. But since Citrix is public, we can still learn a bit about how Wrike looked right at the time of the acquisition from Citrix’s public filings.

5 Interesting Learnings:

#1. Wrike at ~$140m ARR now, $180-$190m est 2021, and break-even (ish). So Citrix paid 12x forward rev for Wrike, a healthy multiple for a company growing 30% but perhaps a discount to some other public comps. 30% is at the low end of high growth, but still counts.

It also puts Wrike at about 2/3ds the size of rival Asana, although Asana is growing significantly faster at 55% year-over-year at $250m ARR. In fact, with Asana’s market cap “just” $5B, Wrike seems fairly valued compared to Asana.

#2. Wrike grew 30% the prior 2 years, and projected to grow 30% again next year. Steady growth approaching $100m ARR and beyond, but not insane growth. A reminder that “solid” growth can still compound to something worth billions.

#3. 1000 employees at $140m in ARR. So about $140,000 in revenue per employee with a global workforce, albeit an HQ in San Jose / SF Bay Area. One example of revenue per employee at a break-even pace.

#4. Wrike going upmarket, biggest customers doubling 2020. This is similar to what we saw with Asana here. Wrike’s fastest growth after $100m ARR is in its enterprise customers, growing 100% vs. just 30% overall.

#5. Citrix lost its investment-grade credit (for now) to finance the deal. Just an interesting note that the deal did stretch Citrix. They borrowed to pay for Wrike in all-cash, and while they plan to return to investment-grade debt soon, they lost it as part of the deal. This will make future acquisitions more expensive.

An incredible outcome for an incredible company that bootstrapped in the early days, and was always capital efficient. Take a look at our deep dive session with CEO Andrew Filev here: