Every once in a while a startup just plain executes from Day 1. It doesn’t happen often, and it’s never quite as linear as it looks. But Samara’s incredible growth makes it look that way.

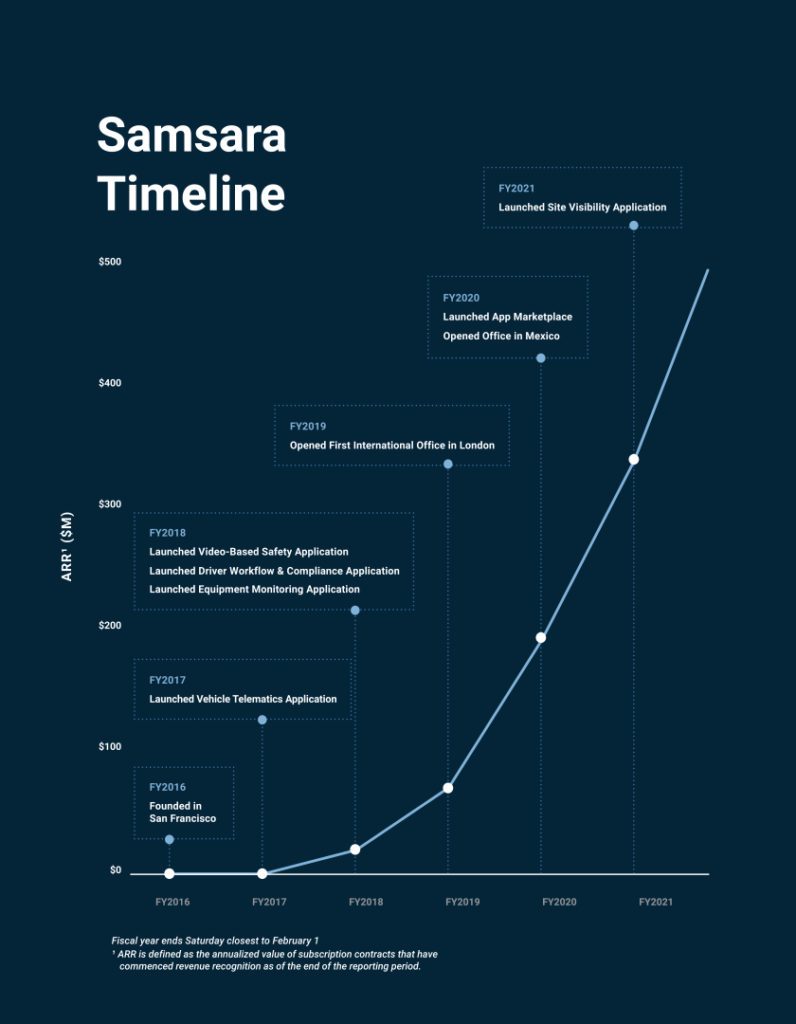

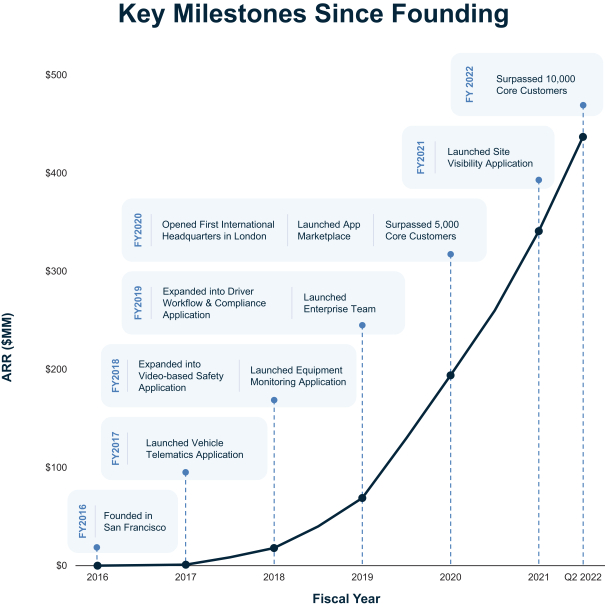

Co-founded by the founders of Meraki, acquired by Cisco for $1B+, the founders decided to do networking again, but this time for connecting fleets, vehicles, and devices. After 18 months building, things just took off when they launched, going from $0 in 2017 to an incredible $500m in ARR in 2021, in just 5 years.

That’s jaw-dropping.

Wow Samsara !!

↗️ $0-$500m in ARR in 6 years

↗️ 72% growth rate at $500m ARR

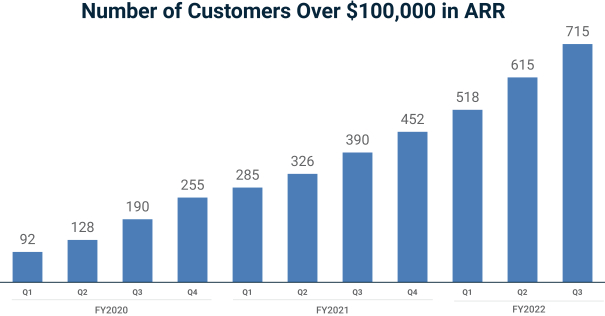

↗️ From 64 $100k+ customers in 2019 to 715 today

↗️ LTV:CAC ratio over 8x pic.twitter.com/lIN3PE1Ehw— Jason ✨BeKind✨ Lemkin #ДобісаПутіна (@jasonlk) November 19, 2021

Most of us will never grow quite like that, even if we do build a unicorn. But we can still learn a lot from Samsara.

5 Interesting Leanings:

#1. Multiple Products and Applications are Key to Growth at Scale. We’ve seen this time and time again. 89% of Samsara’s 700 $100k+ customers used multiple Samsara apps, and 52% of all customers use multiple Samsara apps. And as we’ll see below, Samsara has 2 distinct vehicle/IoT apps, one for video and one for core telematics, that each do $200m ARR. So without doubling its product footprint, Samsara would be less than half the size it is today.

2. Still hit 72% Gross Margins even with a hardware component. This is pretty impressive, many SaaS companies with hardware struggle to hit 60% gross margins. Having customers sign 3-5 year contracts (see below) helps Samsara amortize the hardware costs over a lengthy period.

3. 90% of Revenue Still from U.S., although now expanding internationally. Connected vehicles, in particular, have fairly different regulatory and local variants from country to country. Samsara chose to focus almost entirely on the U.S. until recently, with 7.8% of revenue outside the U.S. in 2020 and 10.2% today. Now global expansion is an increased focus.

4. 694 folks in sales at $500m in ARR — just under half of the total 1,490 total employees, to sell $5k-$100k+ deals. A good yardstick for folks selling direct to both larger SMBs, mid-market, and enterprise. Samsara has 13,000 “core” customers, ones that pay $5k a year or above.

5. 13k “core” customers out of 25k total. As Samsara continues to push more and more into $100k deals, its sub-$5k customers have been de-emphasized. It defines a customer as anyone paying $1k ACV, so while Samsara can service very small customers in the fleet space, in particular, it’s de-emphasizing the low-end of the market (where there are many competitors) and focusing on $5k+ ACV customers. Even while half its customers still pay $1k-$5k a year. The tiny customers ($1k-$5k ACV), while half the customer base, only make up 7% of the revenue. The largest 700 customers that pay $100k represent 44% of the MRR.

And a few more:

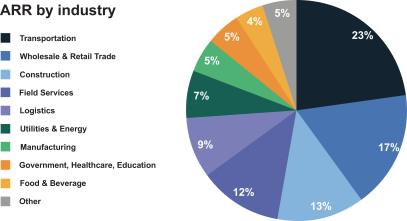

#6. Growing beyond its initial market for fleets of vehicles in Transportation has been key to growth. Transportation was the first target market and remains its #1 vertical, but only 23% of total revenue — although many of the other “verticals” are still fleets of vehicles. 2 main apps account for the vast majority of its revenue. Video telematics and vehicle telematics (core fleet applications) each generate $200m of ARR. So having both applications to sell was the #1 key to getting to $500m in ARR.

#7. NRR of 115%, and 125% for its $100k+ customers. Strong, but nothing out of the ordinary. This is solid NRR for a purchase that is on average $40k ACV, with many smaller customers paying $5k. Backing into the math, if NRR is 125% for $100k customers, it’s likely around 90%-100% for the smallest customers, which is about what you might expect from SMBs.

#8. Adding $100k+ customers has been key to growth. Samsara still has many SMB customers, but adding $100k+ customers fueled growth after $100m ARR. Samsara went from 64 $100k customers in 2019 to 715 in 2021.

#9. Customers sign 3-5 year, non-refundable contracts. This isn’t super uncommon in the connected vehicle space, where long-term contracts have traditionally been paid to offset the upfront hardware costs.

and a final note:

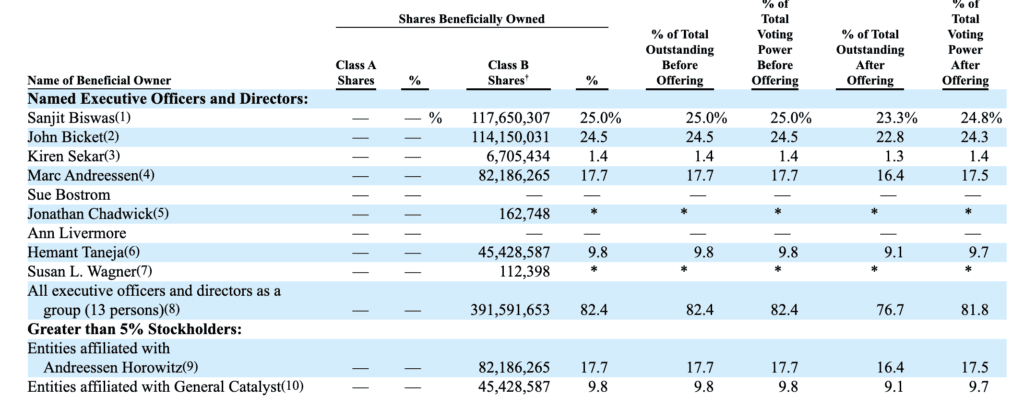

#10. The co-founders still each own 25% of the company. By growing so quickly, and by being repeat founders, they were able to raise just 2 core VC rounds at relatively high valuations. This left each of the co-founders both the largest shareholders, with 25% each.

Wow, what a story Samsara!