SaaStr Academy

SaaStr Blog

The Latest

Blog Posts, Growth, Hiring, Sales

Blog Posts, Growth, Hiring, Sales

Don’t Hire a VP of Sales Everybody Loves

So this is a seemingly simple post, and one with a title that is purposefully a bit binary. Yes, sometimes it’s OK to hire a VP of Sales that everyone loves. But not usually. At least 9 times out of 10, if everyone on the team loves a VP of Sales, it’s the wrong hire….

Continue Reading

Blog Posts

Blog Posts

The Latest at SaaStr Fund: RevenueCat Series B, Gorgias Makes AI Really Work, a Top COO for Owner, and More

Ok we’ve never done a SaaStr Fund news update but thought it might be time to try one! SaaStr Fund manages almost $200,000,000 to invest in Seed and Late Seed B2B startups, from $10k-$200k in MRR. Much more here. Current and past investments include Talkdesk, Algolia, Salesloft (acquired $2.5B), Pipedrive (acquired $1.5B), Greenhouse, Gorgias, RevenueCat,…

Continue Reading

Blog Posts

Blog Posts

The Top Learnings From 15 CEOs of YCombinator’s Top Companies

YCombinator recently put out its list of its Top 50 YC companies of all time based on revenues. We’re fortunate that over the years so many of their founders and CEOs have spoken at SaaStr Annual and Europa! More than half of them, in fact! Let’s take a look at their top sessions: #1. Algolia’s CEO…

Continue Reading

Blog Posts, Early, Featured Posts, Metrics, Videos, Workshop Wednesdays

Blog Posts, Early, Featured Posts, Metrics, Videos, Workshop Wednesdays

The Three SaaS Metrics That Matter in 2024 with SaaStr Founder and CEO Jason Lemkin

What are the three most under-discussed metrics on social media, with VCs, and especially with founders? SaaStr founder and CEO Jason Lemkin shares his top three SaaS metrics that matter in 2024:

Net new customer count

Growth vs. efficiency

The bar to IPO

Blog Posts, Sales

Blog Posts, Sales

Do You Even Need Quotas if You Have a High Performing Sales Team? In Turns Out — Yes

Do you really need quotas in sales? To some that have been raised with a quota, the answer may be of course “Yes”. But to others, quotas seem almost dated, and a bit draconian. Quota or not — won’t reps just close as much as they can — since they want to make their commissions?…

Continue Reading

Blog Posts, Early, Fundraising, Q&A

Blog Posts, Early, Fundraising, Q&A

The Many Types of Angel Investors

Dear SaaStr: Are there different types of angel investors that should be sold differently when trying to raise money to start a business? There are several key types. Let’s break them into several categories: Professional vs. non-professional. Professional angels generally have very specific criteria in terms of valuations, team make-up, check size, etc. You do…

Continue Reading

5 Interesting Things, Blog Posts, Scale

5 Interesting Things, Blog Posts, Scale

5 Interesting Learnings From Zoom at $4.6 Billion in ARR

So Zoom is just that crazy outlier in SaaS. Covid fueled it to insane growth like we’d never seen before, going from $1B ARR to ~$4B ARR … in one year. Yes, one year. But it wasn’t a gift. As the world reopened, we didn’t need quite as much Zoom. And the enterprise business, while…

Continue Reading

Blog Posts, Q&A

Blog Posts, Q&A

Dear SaaStr: What Was Your #1 Hack to Increase Trial Conversions to Paid?

Dear SaaStr: What Was Your #1 Hack to Increase Trial Conversions to Paid? The quickest hack I did was answer all calls and chats immediately. I opened up a remote phone bank / set of agents just to answer trial users’ questions; and I made sure every chat that was in a trial was answered…

Continue Reading

Blog Posts

Blog Posts

The Top 5 Trending SaaStr Europa 2024 Sessions: Gong, Notion, Retool + Open AI + 20VC, Dashlane and Synthesia

So we’re almost there!! 2024 SaaStrEuropa.com is June 4-5 in London! Join us for 2+ fun-filled days, great parties, 100s of braindates and workshops, 1000s of connections, and so much more! And meet everyone from Harry Stebbings to the CEO of Gong! Ok with that, what are the Top 5 Trending Sessions … So far?01…

Continue Reading

Blog Posts

Blog Posts

How Old is The Average Public SaaS Company CEO at Founding? 33 Years Young

So averages can be a bit misleading, especially once you are looking at the Best of the Best. The SaaS companies that actually IPO’d. But those ones are the ones we have great data on. And how old is the average SaaS CEO at … founding? The answer is 33: Some were younger, some older,…

Continue Reading

Blog Posts, Early, Featured Podcasts, Featured Videos, Sales, Sales, Videos, Workshop Wednesdays

Blog Posts, Early, Featured Podcasts, Featured Videos, Sales, Sales, Videos, Workshop Wednesdays

How to Build Go-to-Market Efficiency in SMB Sales with Owner.com CRO Kyle Norton

How do you build GTM efficiency in SMB sales? The CRO at Owner, Kyle Norton, shares his learnings and strategies for building better efficiency into your GTM motion.

While this title is SMB-oriented, the advice applies to Mid-Market and Enterprise, too. The three topics we’ll focus on are:

The importance of staying focused and how to say no.

Ways to scale that don’t include rampant inefficiency and burn.

How to build operational excellence into your organization at different stages of the growth curve.

Blog Posts, Early, Fundraising, Leadership, Q&A

Blog Posts, Early, Fundraising, Leadership, Q&A

Dear SaaStr: How Can I Remove a Troublesome Investor from my Cap Table?

Assume you can’t kick out investors. And plan accordingly. There are some limited exceptions, especially if you do nonstandard types of convertible debt or only raise a very small amount of capital. But for the most part, you are stuck with your investors forever. In the U.S. and Delaware and California, and under standard VC…

Continue Reading

Blog Posts, Q&A

Blog Posts, Q&A

7 Things That Separate The Best Founders From the Less Successful Ones

Dear SaaStr: What Are Some Common Mistakes Made by Less Successful Entrepreneurs? Mistakes less successful (but not total failure) entrepreneurs make: They can’t control the burn rate. You can slow down time if you raise a bunch of VC money, but you can’t stop it. They hide from tougher metrics. High churn, lower-than-hoped margins, low NRR,…

Continue Reading

Blog Posts, Early, Fundraising, Q&A

Blog Posts, Early, Fundraising, Q&A

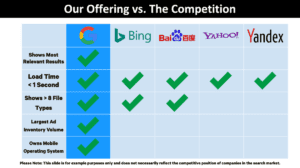

Dear SaaStr: How Much Should I Talk About the Competition in a Pitch Deck?

Dear SaaStr: How Much Should I Talk About the Competition in a Pitch Deck? The best startup pitch decks almost all have great competition slides. Why? Because the best CEOs: Respect the competition. Even if they plan to destroy them. Know the space cold. Even in the early-ish days. See and can explain the whitespace they…

Continue Reading

Blog Posts, Growth, Marketing, Marketing, Sales

Blog Posts, Growth, Marketing, Marketing, Sales

Lead Rich vs. Lead Poor Environments

So last month, two companies I’ve invested in: both crossed $5m in ARR both also grew at the exact same rate last month MoM both also basically have the same ACV (~$50k) both have about the same number of folks on the sales and marketing teams, respectively both have a somewhat complex sale one difference:…

Continue Reading

Popular Q&A

How To Reverse-Engineer a $100M Exit: SaaStr on My First Million Pod

How do you reverse-engineer your first million as a SaaS startup founder? SaaStr founder and CEO Jason Lemkin chats with Sam Parr on the popular YouTube channel and podcast My First Million about what’s required to make it on the map for a $100M exit and then reverse engineers the steps to get there.

Rule 1: New minimum is $400K per employee

Rule 2: Go multi-product

Rule 3: Your second product must be bigger than your first product

Cheat code: Double your prices

Rule 4: 30% of your revenue is international

Rule 5: Localize your product

Cheat code: Remove friction

Rule 6: 100% net revenue retention

Rule 7: Don’t raise double digit millions

Dear SaaStr: What Was the Toughest Rejection You Ever Had in Sales?

Dear SaaStr: What Was the Toughest Rejection You Ever Had in Sales? The hardest rejection I’ve had in sales was around renewals. Especially ones I thought we really had earned. But still lost. In particular, in the early days of EchoSign / Adobe Sign, we had a...

Why the Future of Customer Success, Sales and Marketing Has Changed For Good: Ask-Me-Anything Part 2 with SaaStr CEO and Founder Jason Lemkin

In part one of this week’s Ask-Me-Anything (AMA) with SaaStr founder and CEO Jason Lemkin, he answered the community’s questions about whether all anyone cares about is AI anymore, investor appetites going into 2024, vertical SaaS, and thriving as a solo founder....

Is AI the Only Thing in SaaS that Anyone Cares About Anymore? Ask-Me-Anything Part 1 with SaaStr CEO and Founder Jason Lemkin

In the first part of this open Ask-Me-Anything (AMA), Jason shares his thoughts on the current state of sales and marketing, if anyone really cares about anything other than AI anymore, how to hire great partners, and breaking out of a crowded ecosystem.

Doubling Down: Jay Levy Managing Partner at Zelkova Ventures

"Doubling Down" is a new series where we hear from top B2B SaaS investors on their most recent activities and takes on the current market. Kicking us off is Jay Levy, Managing Partner at Zelkova Ventures. #1. What’s your most recent disclosed investment? Why did you...

Dear SaaStr: Can an Entrepreneur Back Out of a Signed Term Sheet Without Damaging Their Reputation?

Dear SaaStr: Can an entrepreneur back out of a signed term sheet without damaging their reputation? In my experience — Yes, probably. As a founder, you can back out of a term sheet if something is off, or even if you just get another offer you prefer. There is a lot...